Paychex tax calculator

The maximum an employee will pay in 2022 is 911400. The state tax year is also 12 months but it differs from state to state.

The Numbers And Nuances Involved In Calculating A Paycheck Paychex

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Get Started With ADP Payroll. How do I calculate hourly rate.

Free salary hourly and more paycheck calculators. This calculator is intended to provide general payroll estimates only. All Services Backed by Tax Guarantee.

Paychex tiene el compromiso de brindar recursos para la comunidad hispanohablante. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Some states follow the federal tax. Para garantizar que brindemos la información más actualizada y de mayor precisión algunos. Get Started Today with 1 Month Free.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll. While your paychecks are smaller if you go this route youre actually.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Federal Salary Paycheck Calculator. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

How You Can Affect Your Kentucky Paycheck. Ad Payroll So Easy You Can Set It Up Run It Yourself. Next divide this number from the.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Get Your Quote Today with SurePayroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex.

Modifying your pre-tax contributions can often help your bottom line. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

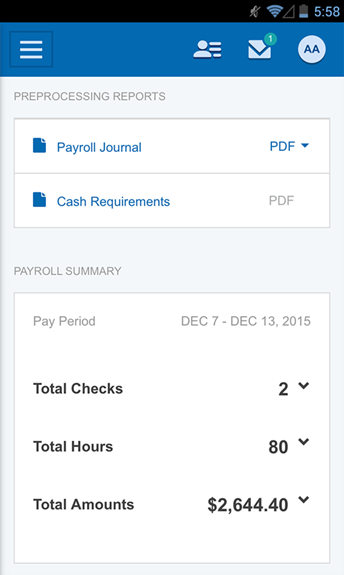

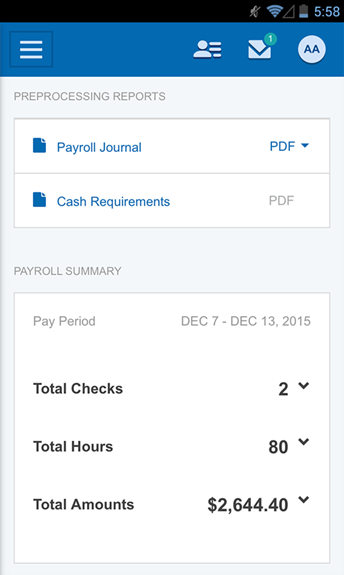

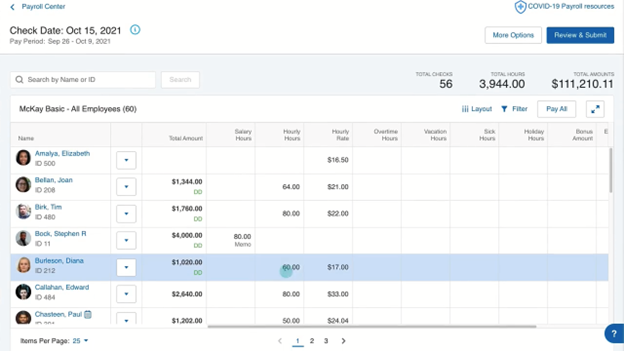

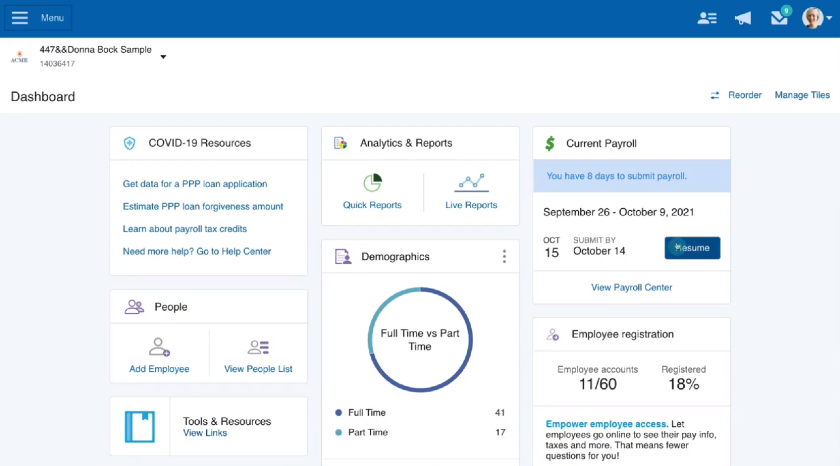

Paychex Flex Demos Paychex

Paychex Flex Demos Paychex

Paychex Flex Demos Paychex

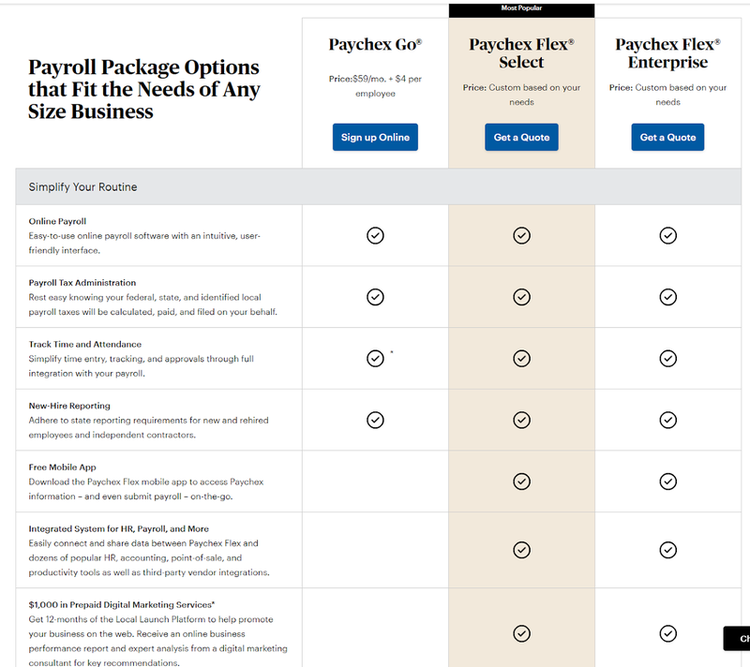

Adp Vs Paychex Which Is Better For 2022

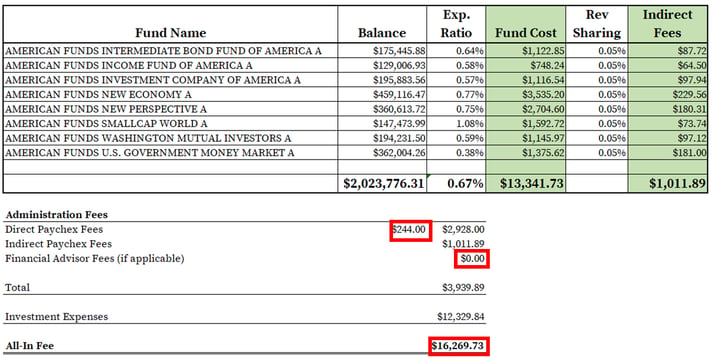

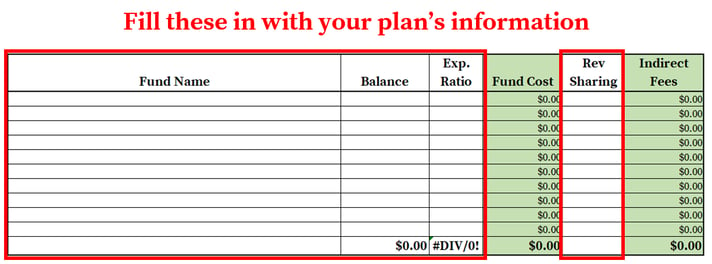

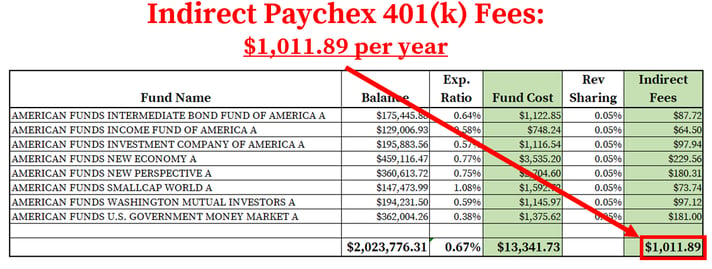

How To Find Calculate Paychex 401 K Fees

Paychex Flex Hr Software Review 2022 Businessnewsdaily Com

How To Find Calculate Paychex 401 K Fees

Paychex Stock Topping Out Nasdaq Payx Seeking Alpha

Paychex Flex Demos Paychex

Paychex Flex Demos Paychex

Paychex Flex Hr Software Review 2022 Businessnewsdaily Com

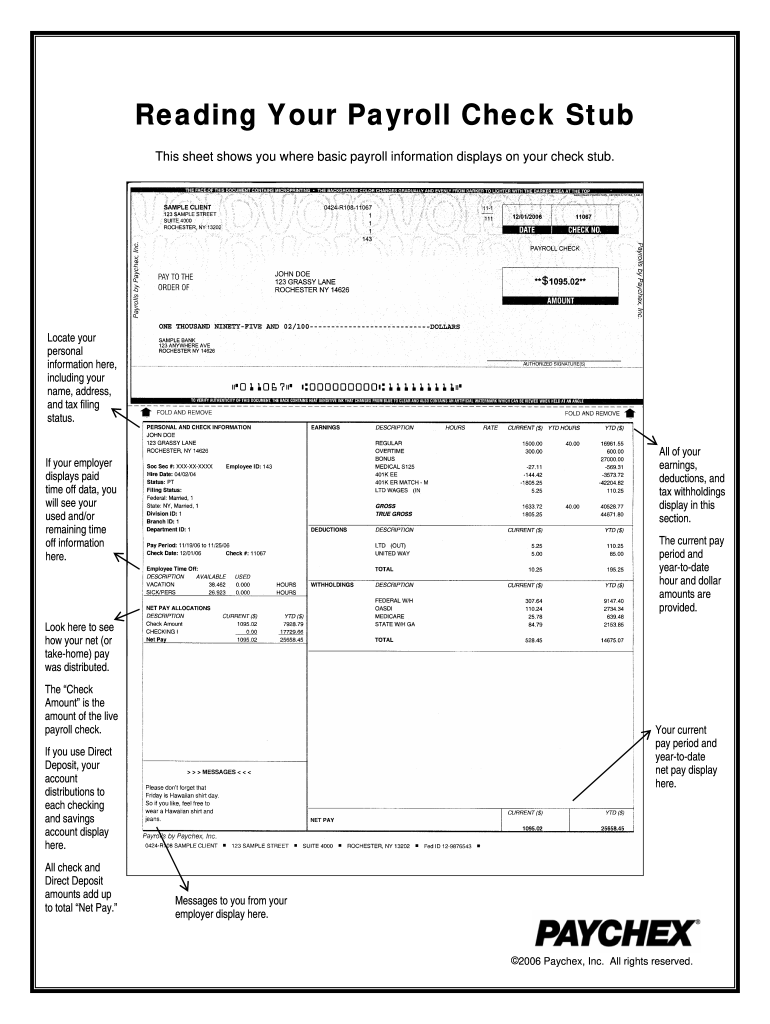

Paychex Pay Stub Generator Fill Online Printable Fillable Blank Pdffiller

Paychex Vs Gusto Compare Pricing Product Features And More Gusto

How To Find Calculate Paychex 401 K Fees

Paychex

Paychex Flex Demos Paychex

Paychex Vs Adp Vs Gusto Pricing Features What S Best